What Does Personal Loans Canada Mean?

What Does Personal Loans Canada Mean?

Blog Article

Personal Loans Canada for Dummies

Table of ContentsPersonal Loans Canada - QuestionsThe 6-Second Trick For Personal Loans CanadaOur Personal Loans Canada PDFsPersonal Loans Canada Fundamentals ExplainedPersonal Loans Canada Fundamentals Explained

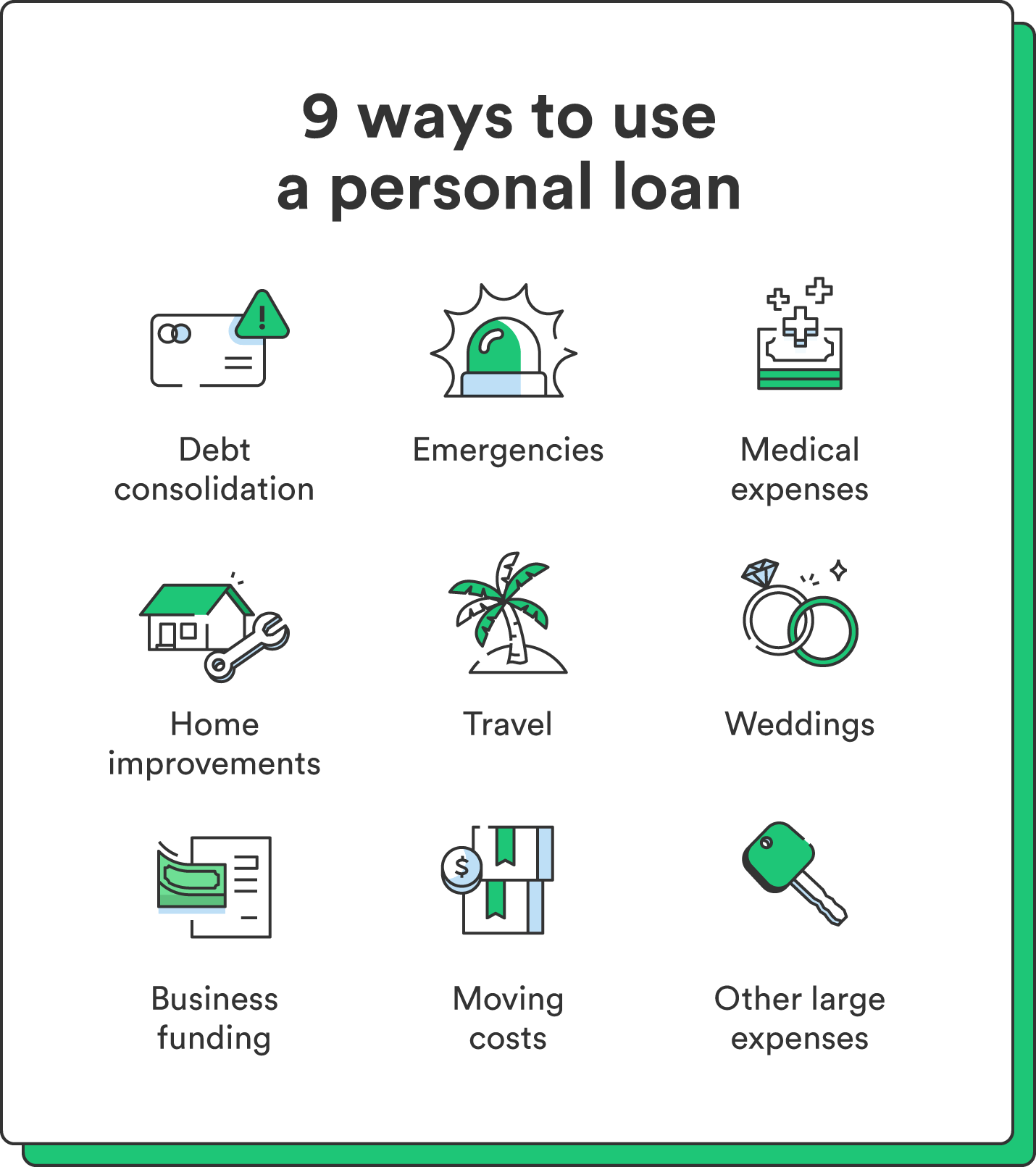

Settlement terms at many individual financing lenders vary between one and 7 years. You receive every one of the funds simultaneously and can use them for virtually any kind of function. Consumers commonly use them to finance a property, such as a car or a boat, settle financial debt or aid cover the price of a significant expense, like a wedding or a home remodelling.

Individual car loans come with a dealt with principal and interest regular monthly repayment for the life of the finance, computed by including up the principal and the rate of interest. A set price provides you the protection of a foreseeable month-to-month repayment, making it a prominent choice for combining variable rate credit report cards. Settlement timelines vary for individual loans, but consumers are usually able to pick repayment terms in between one and 7 years.

Excitement About Personal Loans Canada

You might pay a first source charge of as much as 10 percent for an individual funding. The charge is generally deducted from your funds when you finalize your application, reducing the amount of money you pocket. Individual lendings rates are more directly tied to short-term prices like the prime rate.

You might be provided a lower APR for a much shorter term, because loan providers know your balance will be repaid much faster. They may charge a higher price for longer terms knowing the longer you have a funding, the more probable something might change in your finances that could make the payment expensive.

A personal car loan is also an excellent choice to making use of charge card, considering that you borrow cash at a set rate with a definite payoff day based upon the term you pick. Bear in mind: When the honeymoon mores than, the monthly repayments will be a reminder of the cash you invested.

All About Personal Loans Canada

Contrast interest prices, costs and lender credibility before using for the financing. Your credit history score is a big variable in identifying your eligibility for the loan as well as the rate of interest price.

Prior to using, understand what your score is to ensure that you recognize what to anticipate in terms of expenses. Watch for surprise costs and penalties by checking out the lending institution's terms and conditions page so you don't end up with less money than you need for your economic objectives.

Individual finances require evidence you have the credit score profile and income to repay them. They're much easier to qualify for than home equity financings or other protected lendings, you still require to show the lending institution you have the methods to pay the loan back. Individual car loans are far better than bank card if you want an established monthly settlement and need every one of your web link funds at the same time.

The Personal Loans Canada Diaries

Credit history cards may be much better if you need the versatility to more info here draw cash as needed, pay it off and re-use it. Credit report cards may likewise provide rewards or cash-back alternatives that personal loans do not. Ultimately, the most effective credit scores item for you will rely on your cash routines and what you require the funds for.

Some loan providers may additionally charge costs for individual lendings. Personal loans are car loans that can cover a number of individual expenditures.

As you spend, your available debt is minimized. You can then raise available credit history by making a repayment toward your credit limit. With a personal car loan, there's generally a fixed end date through which the finance will certainly be repaid. A line of credit, on the various other hand, may remain open and readily available to you indefinitely as long as your account stays in excellent standing with your loan provider - Personal Loans Canada.

The cash obtained on the car loan is not tired. If the lending institution forgives the car loan, it is thought about a terminated debt, helpful site and that amount can be taxed. Individual finances might be secured or unsafe. A safeguarded personal car loan calls for some kind of security as a problem of loaning. You might protect a personal finance with money possessions, such as a financial savings account or certification of down payment (CD), or with a physical possession, such as your auto or watercraft.

All about Personal Loans Canada

An unprotected personal finance requires no collateral to obtain money. Banks, credit history unions, and online lenders can provide both safeguarded and unprotected personal finances to qualified debtors. Financial institutions usually take into consideration the latter to be riskier than the former due to the fact that there's no security to accumulate. That can mean paying a greater passion rate for a personal loan.

Again, this can be a bank, lending institution, or on-line personal funding lender. Typically, you would initially finish an application. The lending institution assesses it and decides whether to accept or reject it. If accepted, you'll be offered the funding terms, which you can accept or reject. If you accept them, the next step is finalizing your lending documents.

Report this page